Long-lasting wealth and a life of luxury is surely the desire of everyone, whether a low-income earner or a successful CEO. Everyone wants to live without the mental stress and fatigue of worrying about where the next meal will come from or what the future holds for him. Even though we make the plans to save, however, the sad reality is that most persons are never able to meet up with these goals in the best of times.

Now, with the COVID-19 pandemic still ravaging the world to its foundation in many ways, the thought of saving money can seem impossible to entertain especially to a low-income earner. The hike in living expenses is such that has made merely surviving the harsh times from day-to-day central, with no thoughts of saving.

Yet, it is now more than ever, that we need to focus on creating the future we want for ourselves. Whether a low or high-income earning employee, the good news is that you can still save your way into the future you dream of. Want to know how? Here are eight money-saving tips to practise;

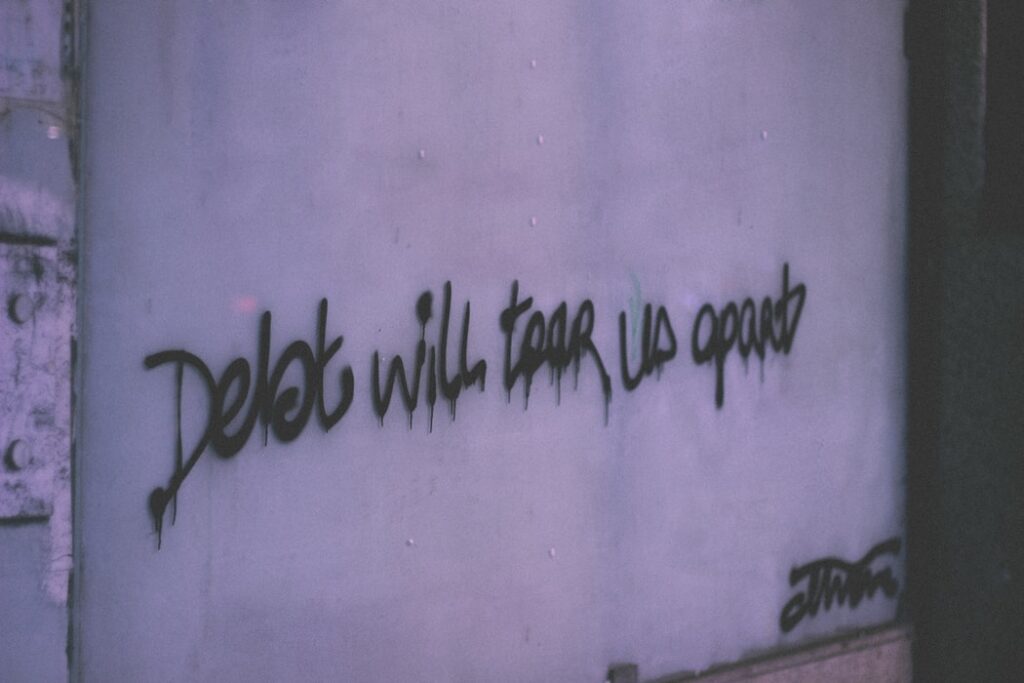

1 Avoid Debts Like The Plague – Debts – especially high-interest debts – are bad for your financial growth. If you want to save more, then a good way to start is to live below your means and avoid incurring unnecessary debts.

2 Stick To Your Budget – Wealth creation is not a game of chance or a sudden happenstance in one’s life. It requires conscious efforts and control over your spending habits. To gain this control, you need to develop the habit of drawing up a weekly/monthly budget that covers your basic needs and learn to stick to it. Look away when you are tempted to make that unnecessary expenses that you didn’t include in your budget initially. It may be hard at the start, but it certainly gets easier with time.

3 Pay Yourself First – The normal inclination of every worker once he receives his paycheck is to sort and pay bills that to be paid and then spend or save the rest. A wealth-growing mindset though would rather do the opposite; that is, save first and then work with the leftover to sort out bills We know it is hard to develop the habit of paying yourself first. But this is not impossible. A great way to do this is to automate a certain percentage of your salary to be deducted from your salary account into a savings account.

4 Home-made Coffee and Lunch Taste Better – Why spend extra bucks on a store-bought coffee and lunch every day at work when you can pack your lunch? Asides being far more affordable, it is also a healthier alternative too. If you feel your work schedule cannot accommodate the extra stress of cooking your meal every morning, then consider preparing them over the weekend and freezing them in portions that you can microwave and take to work each morning.

5 Cut Down On Your Biggest Expenses – If I asked you what your biggest expenses are in a month, would you be able to point them out? To save more, you need to know exactly where the bulk of your money goes to each month and cut down on them. Choose cheaper alternatives of what makes up your biggest expenses or minimise their usage. Recurring expensive costs like data subscription, cable TV subscription, utility bills etc are a great way to cut down on your expenses and channel the excess to your savings account.

6 Save Free Or Unexpected Money – There are times when we receive monetary gifts from family or friends that we weren’t expecting. At such times, the usual tendency is to splurge on new clothes or indulge in other wants since this is free money, right? No, not right! Saving those little money means more money in your savings account.

7 Avoid Gatherings That Make You Spend Money – A Friday’s night-out with the boys or a weekend shopping with the ladies can seem like a great way to unwind you. But what about the financial dent it leaves in your pocket each time you do so? From time to time, opt out of these gatherings in order to save more.

8 Outsource Your Services – Consider earning more in order to save more. Think about those skills that you have which are in demand and outsource your services. By all means, start up a side hustle and save the profits from it.

Read Also: How Companies Can Aid Employee Financial Stability